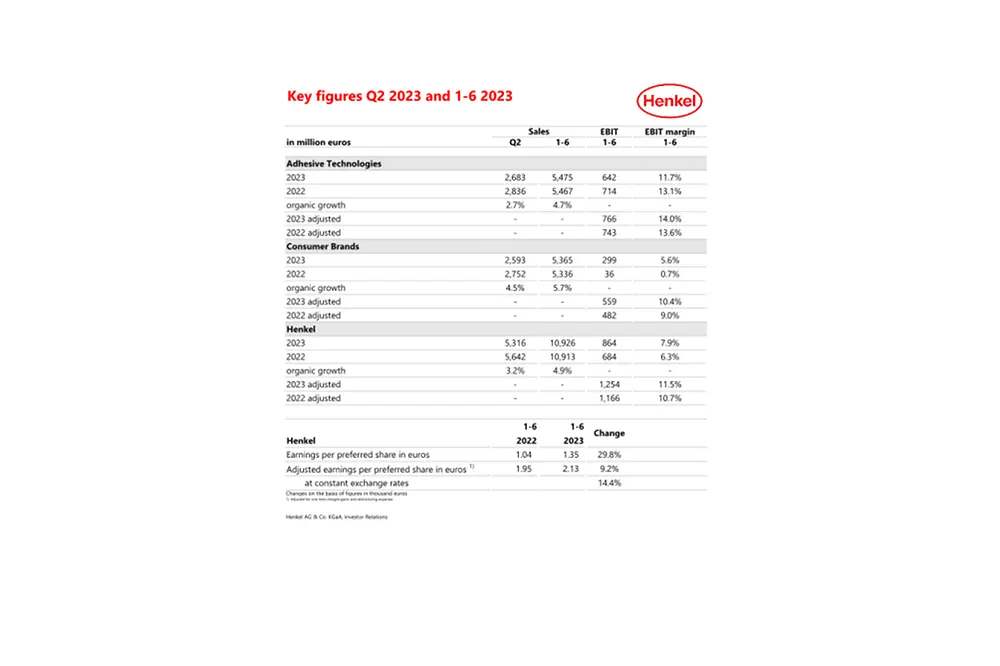

Sustained growth momentum with significant earnings improvement in the first half of the year

- Group sales grows organically by 4.9 percent in the first half of the year to around 10.9 billion euros (nominal 0.1 percent) – very strong growth in both business units

- Operating profit (EBIT)* rises significantly to 1,254 million euros (+7.6 percent)

- EBIT margin* with strong increase to 11.5 percent (+80 basis points)

- Earnings per preferred share (EPS)* increase to 2.13 euros, double-digit growth of +14.4 percent at constant exchange rates

- Implementation of strategic growth agenda consistently driven forward

- Sales and earnings guidance for fiscal year 2023 raised:

- Organic sales growth: to 2.5 to 4.5 percent

- Return on sales (EBIT margin)*: to 11.0 to 12.5 percent

- Earnings per preferred share (EPS)*: increase in the range of +5 to +20 percent at constant exchange rates

Henkel significantly increased sales and earnings in the first half of 2023 in a persistently challenging economic environment.

“We achieved very strong growth in both business units. At the same time, we succeeded in significantly improving our earnings despite the continuing headwinds from high material and logistic prices. Following the strong performance in the first half of the year, we are confident for the remainder of the year and have significantly raised our full-year guidance for sales and earnings,” said Henkel CEO Carsten Knobel.

“We also made good progress in implementing our strategic growth agenda in the first six months of the year. In the Consumer Brands business unit, we are advancing the integration faster than planned. At the same time, we are consistently sharpening our portfolio towards high-margin and high-growth brands and products. This is also reflected in the earnings of the business unit. In the Adhesive Technologies business unit, we have aligned the organizational structure even more closely to our customers to expand our leading global position and further increase growth momentum. In addition, we are driving forward important initiatives in the areas of sustainability and digitalization to further enhance our competitive position,” explained Carsten Knobel.

Outlook for fiscal 2023 raised

At Group level, Henkel now expects organic sales growth of 2.5 to 4.5 percent in fiscal 2023 (previously: 1.0 to 3.0 percent). For the Adhesive Technologies business unit, growth is expected to be in the range of 2.0 to 4.0 percent (previously: 1.0 to 3.0 percent), and for the Consumer Brands business unit, between 3.0 to 5.0 percent (previously: 1.0 to 3.0 percent). Adjusted return on sales (EBIT margin) at Group level is now expected to be in the range of 11.0 to 12.5 percent (previously: 10.0 to 12.0 percent). For the Adhesive Technologies business unit, adjusted return on sales is expected in the range of 13.5 and 15.0 percent (previously: 13.0 to 15.0 percent), and for the Consumer Brands business unit of 9.5 and 11.0 percent (previously: 7.5 to 9.5 percent). For the development of adjusted earnings per preferred share (EPS) at constant exchange rates, Henkel now expects an increase in the range of +5 to +20 percent (previously: -10 to +10 percent).

Sales and earnings development in the first half of 2023

At 10,926 million euros, Group sales in the first half of 2023 were 0.1 percent above the prior-year level (Q2: 5,316 million euros, -5.8 percent). This corresponds to a very strong organic sales growth of 4.9 percent (Q2: 3.2 percent). Foreign exchange effects had a negative impact on sales development of -2.5 percent (Q2: -5.8 percent). Acquisitions and divestments reduced sales by -2.2 percent (Q2: -3.2 percent).

Sales growth in the first half year was driven by both business units. Adhesive Technologies recorded very strong organic sales growth of 4.7 percent, driven by the Mobility & Electronics and Craftsmen, Construction & Professional business areas. Consumer Brands achieved very strong organic sales growth of 5.7 percent, driven by the Laundry & Home Care and Hair business areas.

In the first half of the year, organic sales growth in the Europe region reached 2.4 percent (Q2: 0.8 percent). In the IMEA region, sales increased organically by 25.7 percent (Q2: 23.6 percent). North America posted organic sales growth of 3.8 percent (Q2: 0.9 percent). The Latin America region recorded organic sales growth of 13.2 percent (Q2: 9.4 percent). By contrast, the Asia-Pacific region recorded a negative organic sales development of -2.7 percent (Q2: -0.6 percent), mainly due to the persistently challenging market environment in China.

Adjusted operating profit (adjusted EBIT) rose in the first half of the year by 7.6 percent to 1,254 million euros, compared to 1,166 million euros in the prior-year period. This increase was supported by the development of selling prices, by savings from the creation of the integrated Consumer Brands business unit and by portfolio optimization measures.

Adjusted return on sales (adjusted EBIT margin) increased by 80 basis points to 11.5 percent.

Adjusted earnings per preferred share rose to 2.13 euros in the first half of 2023. At constant exchange rates, this is an increase of 14.4 percent compared to the prior-year period.

Net working capital increased by 0.8 percentage points to 6.1 percent of sales (prior-year period: 5.2 percent).

The Free cash flow reached 749 million euros and with this, significantly exceeded the level in the first half of 2022 (46 million euros), due in particular to the higher cash flow from operating activities in the fiscal year.

The net financial position as of June 30, 2023, amounted to -1,311 million euros (December 31, 2022: -1,267 million euros).

On April 20, 2023, Henkel had announced the signing of an agreement to sell its business activities in Russia to a consortium of local financial investors. The company had announced the exit of its Russian operations following the Russian attack on Ukraine last year. The transaction has been closed, and the sale price amounts to 54 billion rubles (around 600 million euros).

Development of the business units in the first half of 2023

Sales of the Adhesive Technologies business unit recorded a stable nominal development of 0.1 percent to 5,475 million euros in the first half of 2023 (Q2: 2,683 million euros, -5.4 percent). Organically, sales increased by 4.7 percent (Q2: 2.7 percent). This development was achieved through double-digit price increases, while volumes remained below the prior-year level due to muted demand in some relevant end markets. The Mobility & Electronics business area achieved double-digit organic sales growth of 10.9 percent (Q2: 9.2 percent). In the Packaging & Consumer Goods business area, organic sales development was -1.5 percent (Q2: -3.7 percent). In the Craftsmen, Construction & Professional business area, sales increased organically by 4.9 percent (Q2: 2.9 percent). Adjusted operating profit increased by 3.0 percent to 766 million euros in the first half of 2023, compared to 743 million euros in the prior-year period. Adjusted return on sales increased to 14.0 percent compared to 13.6 percent in the prior-year period. Here, price increases in particular had a positive impact.

The Consumer Brands business unit generated sales of 5,365 million euros in the first six months of 2023 (Q2: 2,594 million euros). This corresponds to a nominal development of 0.6 percent (Q2: -5.7 percent). Organically, sales increased by 5.7 percent, driven by pricing (Q2: 4.5 percent). By contrast, volumes declined, partly also due to the ongoing portfolio optimization measures. The Laundry & Home Care business area recorded very strong organic sales growth of 5.3 percent (Q2: 4.4 percent). The Hair business achieved an overall organic sales increase of 7.9 percent in the first half of 2023 (Q2: 6.1 percent). The Other Consumer Businesses recorded a flat sales development in the first half of the year (0.0 percent, Q2: -1.4 percent). Adjusted operating profit was 559 million euros, 15.9 percent above the level of the prior-year period. This increase was supported by the development of selling prices to further compensate for the still high direct material prices, savings from the integration of the consumer goods businesses in the new Consumer Brands business unit, and by portfolio optimization measures. Adjusted return on sales increased to 10.4 percent.

Implementation of the growth agenda consistently driven forward

In the first half of 2023, Henkel continued to consistently drive forward the strategic priorities of its purposeful growth agenda and achieved good progress in all areas.

In the first half of 2023, the merger of the former Laundry & Home Care and Beauty Care businesses into the Consumer Brands business unit was driven forward faster than planned. In the process, Henkel achieved further savings – overall, the company aims to realize net savings (before reinvestments) of at least 400 million euros by the end of 2026. Henkel has also further focused its Consumer Brands portfolio. In the process, brands and activities with total sales of around 0.5 billion euros have been divested or discontinued since the announcement of the merger of the consumer businesses. At the same time, Henkel strengthened its portfolio with the acquisition of the Laundry & Home Care brand Earthwise in New Zealand. The integration of Shiseido’s Hair Professional business in Asia-Pacific, which Henkel had acquired last year, is well on track, and the business is performing well.

As part of the second phase of the integration, which was started at the beginning of this year and which focuses on supply chain excellence, initial measures have been implemented. This includes, among other things, the consolidation of the production network for the European Hair and Body Care business. In addition, the so-called 1-1-1 principle has been introduced in first countries. This relates to driving forward commercial integration with optimized logistics processes in line with the “one face to the customer” principle. This means: one order, one delivery, one invoice.

In the Adhesive Technologies business unit, Henkel established an optimized organizational structure in the first half of 2023. This enables the business unit to use scale and competence benefits even more efficiently along the three business areas Mobility & Electronics, Packaging & Consumer Goods, and Craftsmen, Construction & Professional, while at the same time ensuring close proximity to customers and markets.

To further strengthen its competitiveness, Henkel focuses on strong innovations in attractive business areas. These again contributed to growth in both business units in the first half of 2023. In Adhesive Technologies, for example, Henkel's innovative solutions used in the production of electric vehicles recorded an organic sales increase of around 70 percent in the first six months of the year compared to the prior-year period. In the Consumer Brands business unit, the Persil brand achieved double-digit organic sales growth, supported by a relaunch with a unique new enzyme technology which was rolled out across 30 countries.

Henkel also made further progress in the area of sustainability. For example, on the way to achieving a climate-positive carbon footprint for its production sites by 2030, Henkel converted ten additional sites to CO2-neutral production in the first half of 2023. Henkel has also continued to drive forward important initiatives in the area of digitalization. Here, the use of artificial intelligence is playing an increasingly important role.

“Overall, we are proud of the successful business performance in the first half of the year and the good progress we have made in implementing our strategic agenda – despite the persistently difficult economic environment,” said Carsten Knobel. “We are very confident that we will successfully shape the future for Henkel. Together as a highly motivated team, based on a strong corporate culture and with a clear growth strategy. In the Adhesive Technologies business, we are global leader and offer innovative solutions with a clear focus on future trends such as mobility, connectivity, and sustainability. And with the new Consumer Brands business unit, we have laid the foundation for further profitable growth in our consumer business.”

* Adjusted for one-time expenses and income, and for restructuring expenses.

This document contains statements referring to future business development, financial performance and other events or developments of future relevance for Henkel that may constitute forward-looking statements. Statements with respect to the future are characterized by the use of words such as expect, intend, plan, anticipate, believe, estimate, and similar terms. Such statements are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. These statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially (both positively and negatively) from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update forward-looking statements.

This document includes supplemental financial indicators that are not clearly defined in the applicable financial reporting framework and that are or may be alternative performance measures. These supplemental financial indicators should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.